State-by-State List of Statute of Limitations on Debt

A statute of limitations is the amount of time a person can take in order to take legal action on a certain event. When it comes to debt, the statute of limitations is the amount of time a creditor can take before asking the court to force you to pay for a debt. The court system doesn't keep track of the statute on your debt. Instead, it's your responsibility to prove the debt has passed its statute of limitations.

Time-Barred Debts

Debts that have passed the statute of limitations are known as time-barred debts. However, just because the debts have aged past the statute of limitations doesn't mean that you no longer owe money or that your credit rating cannot be impacted. It just means the creditor won't get a judgment against you—as long as you come to court prepared with proof that your debt is too old.1

Proof might include a personal check showing the last time you made a payment or your own records of communication that you've made about that debt.

Categories of Debt

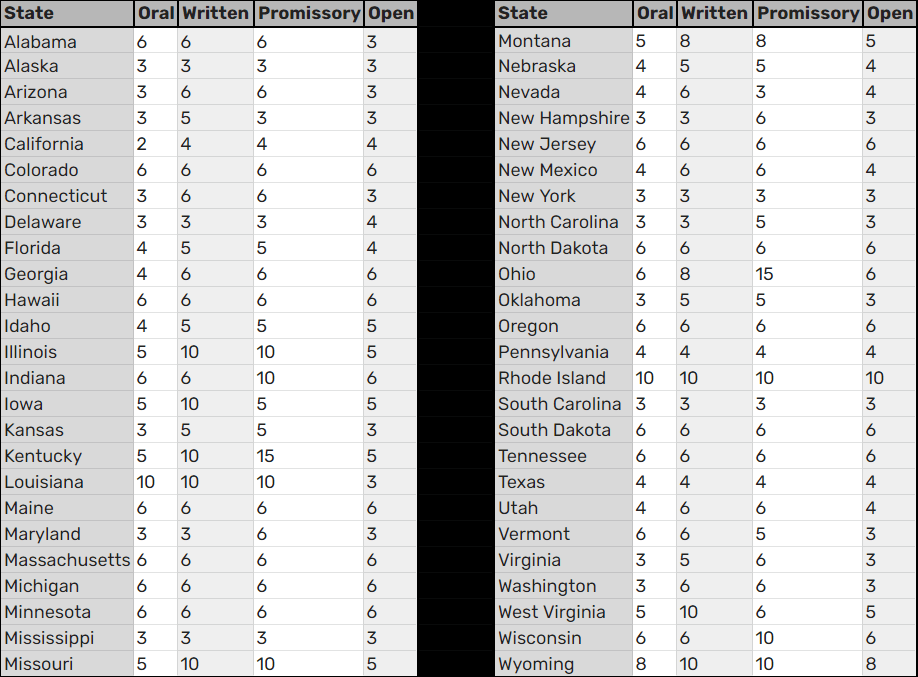

Debts fall into one of four categories.2 It's important to know which type of debt you have because the time limits are different for each type. If you're in doubt, check with your attorney about which type of debt you have.

- Oral agreements: These are debts that were made based on a verbal agreement to pay back the money, and there is nothing in writing.

- Written contracts: All debts that come with a contract that was signed by you and the creditor falls in the category of a written contract—even if it was written on a napkin. However, a written contract must include the terms and conditions of the loan. For example, the amount of the loan and the monthly payment must be included. Medical debt is one kind of written contract.

- Promissory notes: A promissory note is a written agreement to pay back a debt in certain payments, at a certain interest rate, and by a certain date and time. Home loans and student loans are two examples of promissory notes.45

- Open-ended accounts: An account with a revolving balance you can repay and then borrow again is open-ended. Credit cards, in-store credit, and lines of credit are all examples of open-ended accounts. If you can only borrow the money one time, it is not an open-ended account.

Statutes of Limitations for Each State

Each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. Usually, it is between three and six years, but it can be as high as 10 or 15 years in some states. Before you respond to a debt collection, find out the debt statute of limitations for your state.

If the statute of limitations has passed, there may be less incentive for you to pay the debt. If the credit reporting time limit (a date independent of the statute of limitations) also has passed, you may be even less inclined to pay the debt.

These are the statutes of limitation, measured by years, in each state, as of June 2022.

Frequently Asked Questions (FAQs)

When does the statute of limitations on debt begin?

The clock starts on the last day you had any activity on the account (The first date of delinquency). Activity may include making a payment, establishing a payment arrangement, or simply acknowledging liability for the debt.

What can restart the debt statute of limitations?

Any new activity on your account can restart the statute of limitations for your debt. If you make a new charge on the account, set up a payment, enter an agreement, or conduct any other activity, the clock could start over.

Why are there statutes of limitations?

Statutes of limitations are meant to put a time limit on creditors or debt collectors that may seek to take legal action to collect a debt. If a debt passes the time limit, the creditor can no longer file a lawsuit against the debtor. This protects debtors from forever being exposed to liability for old debts.

Statute of Limitations for

Reporting to the Bureaus

The credit reporting time limit is the amount of time a creditor or debt collector can report information about a delinquent account on your credit report. In most cases, a consumer reporting agency may not report negative information that is more than seven years old or bankruptcies that are more than 10 years old. The negative information will typically remain on your report for seven years. This is the time frame that you’ll want to pay attention to when looking at your credit report.

Many people confuse the statute of limitations with the credit reporting time limit. They assume that once the 4-5 year statute of limitations is up on the ability to collect and sue for the debt, the delinquent information will be removed from their credit report. However, the statute of limitations typically has no bearing on your credit report.

Rather, it is the typical credit reporting time limit of 7 years that dictates how long negative information remains on your credit report.

This means that even if the statute of limitations on your debt has expired, negative information can remain on your credit report for several more years.

Once the credit reporting time limit has been reached, the negative information should automatically fall off of your credit report. If for some reason it doesn’t, you can dispute the information using the credit dispute process. Reviewing your credit report regularly can help you ensure that all of the information is accurate and up to date.

If you have negative information on your credit report that you believe is inaccurate or past the credit reporting time limit, remember that you have rights as a consumer. It is illegal for a creditor to re-age a debt to lengthen the amount of time it’s on your report.